For a customer, there’s no better feeling than making and spending money at the same time. And this is the exact premise of a cashback reward program: receiving a small amount back after each purchase. But is this kind of program really enough to keep buyers around in the new customer reality? How different is it from a loyalty program? And most importantly, how can you execute a cashback reward campaign? All of these questions will be answered in this guide.

What Is a Cashback Reward Program?

Cashback reward programs are characterized by a simple, yet addictive formula: with every purchase a customer makes, they earn a small amount of money back. Cashback offers are popular, because they provide instant gratification, reinforcing the customer’s decision to shop. However, a major downside of a cashback reward program is that its focus on instant gratification and financial incentives comes at the expense of long-term appreciation.

The concept of cashback is definitely not new, but it has been reinvented time and time again as technology has changed. Some of the latest novelties include:

- Cashback offers are personalized based on the customer’s location and purchase history

- The cashback reward program is available in an app for maximum convenience

- Cashback rewards are instantly applied when using a specific card thanks to card-linked technology

What Kind of Businesses Benefit from a Cashback Reward Program?

Not all businesses benefit from offering cashback. For instance, luxury fashion brands would risk cheapening the experience for their customers, who typically expect special perks and privileges. Generally speaking, cashback works well in the finance industry offered by banks or credit card companies. Malls, airports and other large retail hubs may also utilize a cashback reward program with greater efficiency, as they are dealing with a large number of brands from a variety of verticals.

Lastly, these programs are ideal for wholesale businesses that sell their products through retailers, but still wish to build a stronger bond with their customers. By offering a cashback deal, wholesalers can convince customers to skip the middleman and purchase directly from them, allowing the business to collect valuable data they would have otherwise lost when selling through the retailers.

Should Cashback Be a Loyalty Program Reward?

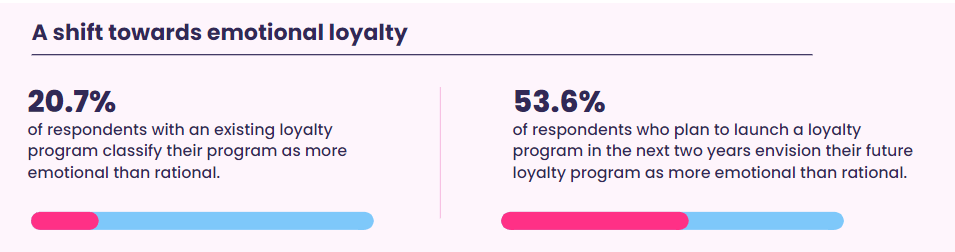

When planning the concept for their cashback reward program, companies often ponder whether they should make it part of a full-fledged loyalty program, or whether the cashback alone is enough to retain customers. A few years ago, one could have made a solid argument for the latter, citing past studies that pointed out that financial benefits such as coupons and cashback were the most popular incentives.

However, things have changed since 2019. The recent digital transformation has changed customers’ expectations, who now demand personalization, experiential rewards, and non-transactional engagement more than ever. The biggest drawbacks of a cashback reward program are that it focuses purely on transactional benefits, and adding meaningful additions to the system (e.g. badges, challenges or gamification) takes a significant amount of time, effort and money.

Combining Cashback Reward Programs and Loyalty Programs

Another issue with having a standalone cashback reward system is that competitors can easily copy the concept and introduce their own cashback offers. And if they offer better rates or other rewards, your system will be less appealing in comparison.

All in all, featuring cashback offers as part of a loyalty program promises a much more enticing deal for customers. Even though launching a loyalty program initially requires more planning and is a bigger investment, it also produces better results:

- A loyalty program offers more ways to retain customers besides cashback, like tiers

- It offers a much more meaningful experience to customers

- It’s easier to expand the core technology with new modules

- Loyalty programs provide more opportunities for data collection and personalization

- 93.1% of program owners who measure returns say they see a positive ROI, meaning that even if the initial investment is high, returns will come over time

Setting Up a Cashback Reward Program in 3 Easy Steps

There are a number of ways to establish a cashback reward program:

- Build the technology in house to manage it

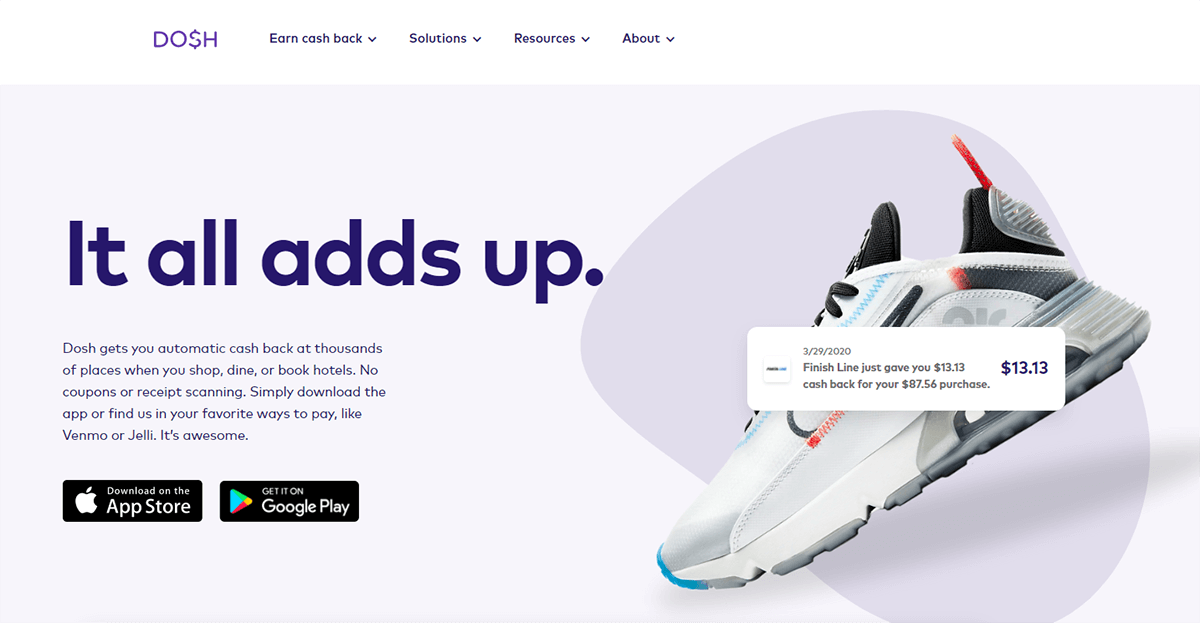

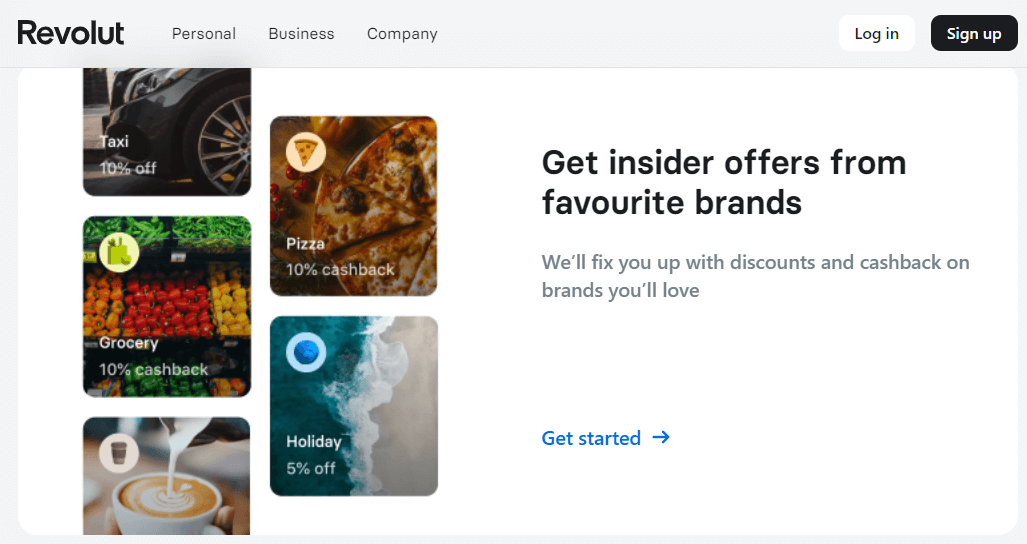

- Partner with a third-party card provider or app

- Utilize your loyalty program platform and add cashback as a feature

Naturally, partnering with a third-party card provider or cashback app is the quickest, easiest and most straightforward way to go. They already have established technology and a userbase. Partnering with a company such as Revolut means you can add your own cashback offers to their list of incentives.

On the other hand, this would also mean that your brand is just one among the many within their network. This oftentimes pressures companies to stand out via increasing the amount of cashback they offer, ultimately biting into their profit margin. Moreover, companies miss out on valuable data they could otherwise harness with their own solution.

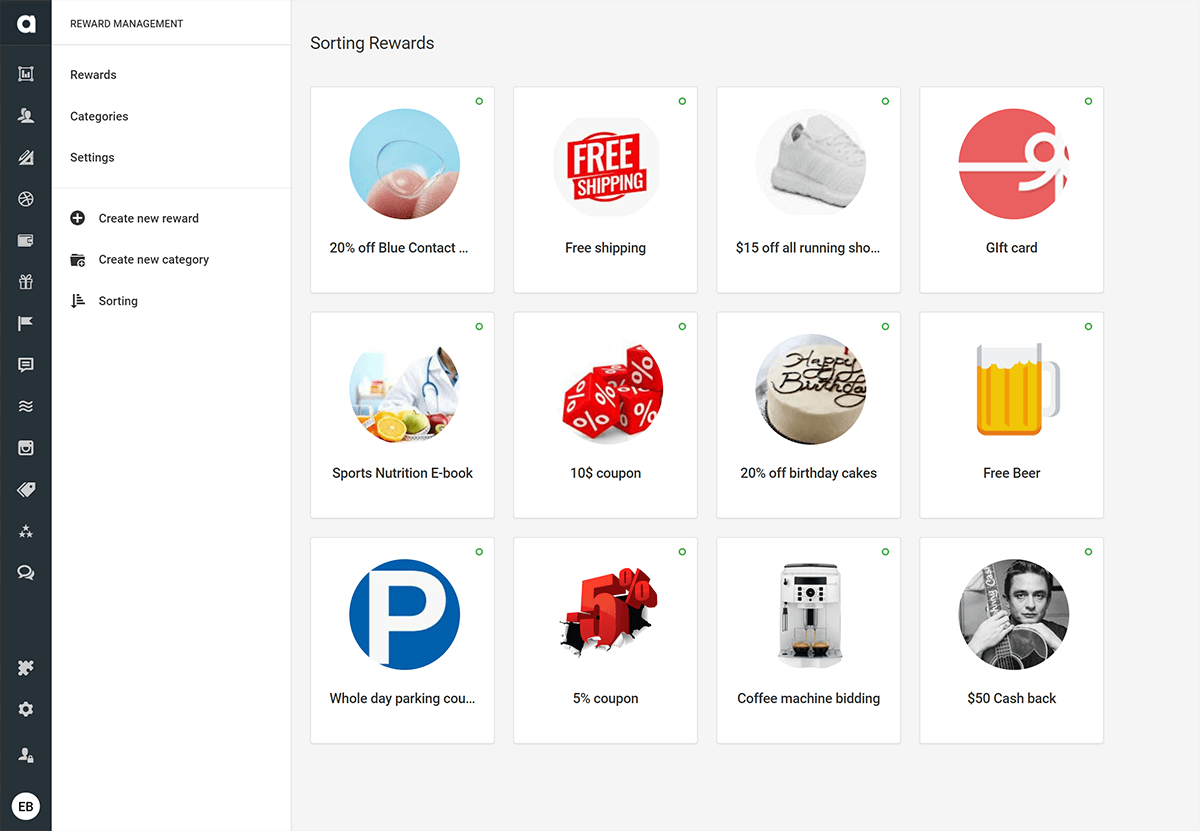

Avoid offering a single feature, such as cashback, by itself. Instead, make it part of another program element, like a program type. For example, if you offer high-value cashback deals, then make them a gold-tier reward, so that only the most dedicated, most valuable customer can get access to it

As such, it’s time to look at how to set up a cashback offer in a more complex system, like a loyalty program.

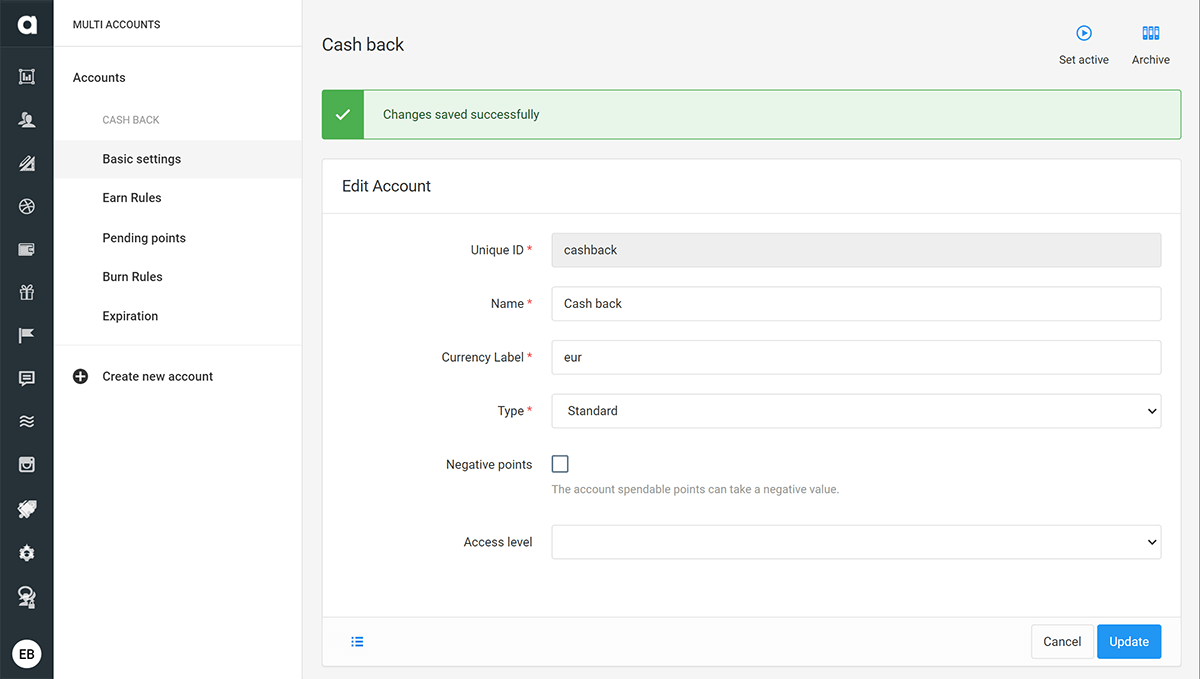

Step 1: Create a Cashback Account

Cashback points and reward points are often a topic of confusion. Though both are granted for making a purchase, cashback points determine the amount of money customers receive, while reward points are a program-specific currency that can be redeemed for a coupon, or spent on gifts and benefits. Reward points can also be used to calculate a member’s tier status.

It’s critical to understand that cashback points and rewards points are not interchangeable. As such, they should be calculated in different accounts to avoid confusion and complication within the reward system. In case of a loyalty program with cashback capabilities, platform users are required to set up an additional cashback account.

The sole purpose of the cashback account is to keep track of how much cashback customers are eligible for, without affecting members’ reward points balances.

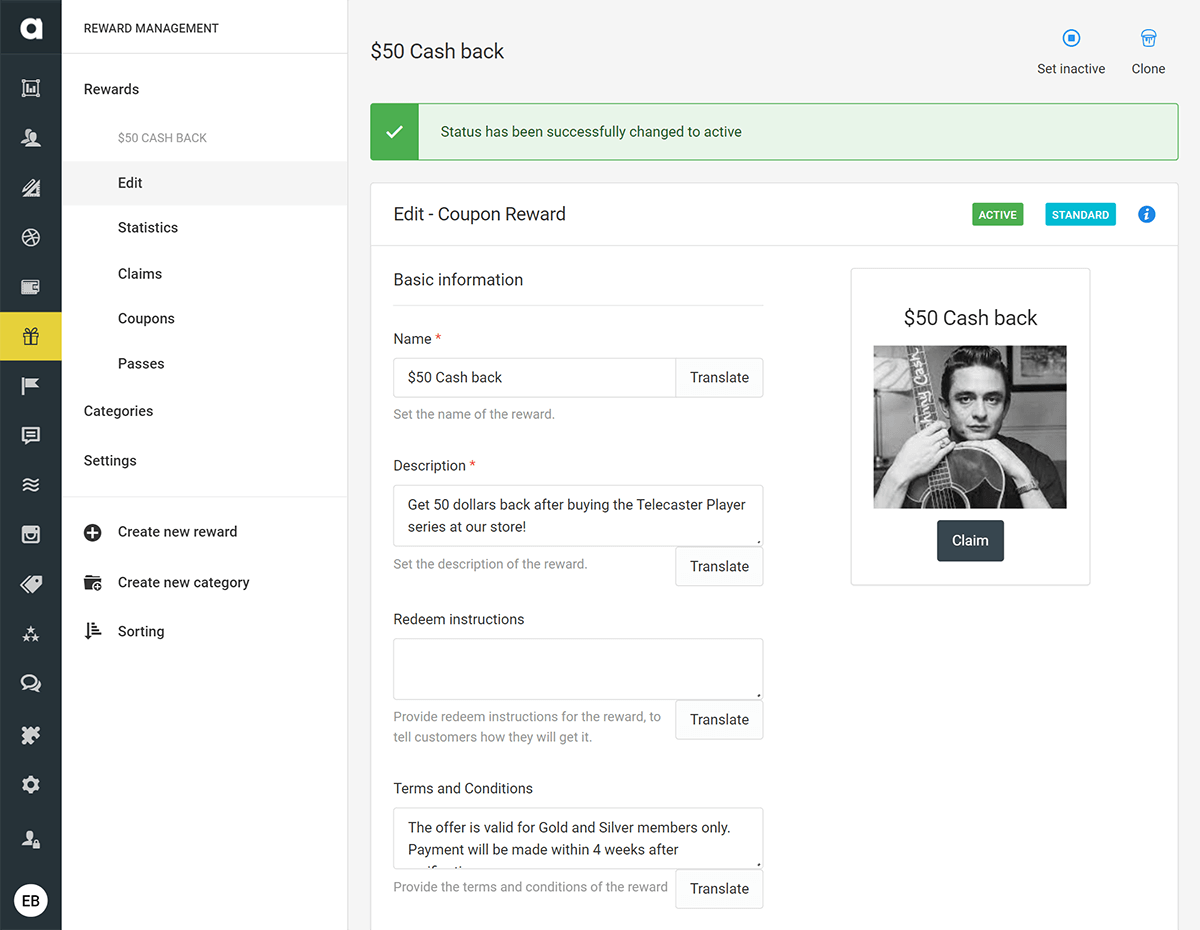

Step 2: Set Up Cashback Campaigns

Remember: in this day and age, one-size-fits-all solutions are no longer viable, and cashback reward campaigns are no exception. While setting up a campaign where all customers earn the same amount of cashback on all offers might feel like the easiest option, it won’t be that appealing from the customer’s perspective.

Instead, consider building different campaigns with different cashback rates based on a variety of criteria:

- The type of transaction – offer an extra-special rate for in-store, webshop or app-based orders; this will help you drive sales through a the sales channel of your choice

- Region – Offering larger cashback bonuses for a limited amount of time in a new region helps to quickly establish a customer base

- Product – Raising the cashback rate for certain brands or product types diverts attention to them. This is a great strategy for clearing out old stock or highlighting new arrivals.

Before the cashback reward program’s new campaign goes live, be sure to set the incentive. There are two options:

- Customers receive a specified amount of money back, e.g. “$15 cashback on all T-Shirts”

- Customers receive a percentage-based deal, e.g. “Get 5% back for every dollar spent”

Step 3: Managing Cashback Requests

Seamless process management is a vital part of any cashback reward program. Once a customer makes a purchase, you need to collect the relevant information to execute the cashback offer. Based on the complexity of your campaign, this can mean the purchase value, product categories, region, and so on.

Gathering this information is rather straightforward for an eCommerce shop, but if you are running cashback deals in brick-and-mortar stores, you need to have a POS system or ask customers to scan and send in their receipts in order to receive their cashback.

Once your Order Management System has all the necessary information, it must be able to share it with the platform handling the cashback campaigns. This requires integration and will ensure the customer’s cashback account is updated properly. If you opt for a loyalty management platform like Antavo, the integration with your Order Management System will be established as part of the implementation process.

Last, but definitely not least, you need to decide how to deliver the cashback:

- The money can be sent through a fulfillment partner

- Use wire transfer to grant the cashback

- Or let customers use the cashback toward their next purchase

Starting Your Cashback Reward Program

This article was created to give you a better understanding of how to execute a cashback reward program. Keep in mind that, though cashback is an exciting and highly welcomed incentive, it won’t build brand loyalty in customers. Therefore, it pays to plan for the long term, and to build a loyalty program that goes beyond financial benefits and creates meaningful moments through emotional loyalty.

Ready to discuss the finer details of a cashback reward program? Or do you have ideas for a more grandiose loyalty program project? Our experts would be happy to discuss it with you. Get the conversation rolling by booking a demo, or if you have an RFP, we invite you to submit it here.

In the meantime, download our Global Customer Loyalty Report for an in-depth look at how loyalty program features and benefits, like personalization and ROI are perceived across the globe.